Alright, listen up, you day trading gamblers and wannabe hedge fund legends, if you’ve ever watched the market implode in real time and thought, “What the actual f*ck just happened?”*, chances are, it had something to do with the Federal Reserve (the Fed). Yeah, the big dogs in charge of America’s money printer. These guys don’t just sit around sipping overpriced coffee—they control the cost of money itself.

Think of the Fed like a bouncer at an exclusive nightclub. When they’re feeling generous, they let everyone in, and the party gets wild—stocks pump, crypto goes to the moon, and every crypt bro with $100 in Bitcoin suddenly thinks they’re a financial guru. But when the Fed decides the club is overcrowded and full of idiots, they slam the door shut, jack up the price of drinks (aka interest rates), and suddenly, everyone’s getting kicked out—aka, the market crashes.

So, why should you care? Because if you don’t, you’re gonna end up being the guy who buys the top and panic sells the bottom. The Fed is the ultimate puppet master, and if you don’t know how their little game works, you’re just another clueless idiot getting rekt. Their operation is not as complicated but it can get tricky, so if you ever wondered:

❓What FOMC meetings are?

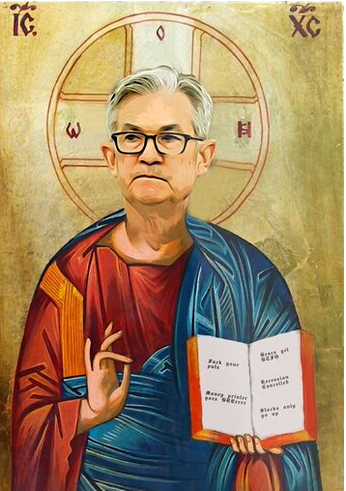

❓Why traders pray to an old guy names Jerome Powell?

❓What the f*ck an interest rate actually is and why it controls your financial life?

❓And how to actually be able to understand and react to macro factors?

buckle up, because by the end of this, you’ll know exactly why the market does what it does, and more importantly, how to play the game before it plays you.

What Is the Federal Reserve (Fed) & why does it exist?

Alright, before we start throwing around terms like "interest rates" and "monetary policy," let’s talk about the Fed, the biggest market manipulator in existence. You think whales dumping your favorite shitcoin is bad? Wait until you see what happens when the Fed decides it's time to "adjust" the economy.

The Federal Reserve (or just "the Fed" if you don’t feel like wasting syllables) is the central bank of the United States. Their job is to control the money supply and keep the economy from turning into a flaming dumpster fire.

They were born in 1913, after the U.S. government realized that the banking system was a chaotic free-for-all where rich assholes could crash the economy for fun and then just walk away. (Not much has changed, tbh.) Congress was like, "Hey, maybe we should have a group of people in charge of making sure the financial system doesn’t completely eat shit every few years?" And boom—the Fed was created.

What the hell does the Fed actually do?

🤤💰🤑 THEY PRINT MONEY 🤤💰🤑

Well… kind of.

If you’ve ever heard someone ranting about “money printer go brrr”, they’re probably talking about the Federal Reserve. And yeah, the Fed has the power to increase the money supply, but it’s not as simple as Jerome Powell pressing a button and handing everyone free Lambos.

Here’s how it actually works:

When the Fed wants to boost the economy, they buy government bonds (we’ll get into this later). This pumps money into the system. The fancy term for this is quantitative easing (QE)—aka, money printer go brrr.

When the Fed wants to slow down inflation, they sell government bonds, which pulls money out of circulation. This is called quantitative tightening (QT)—aka, making money scarce so the economy doesn’t turn into a wild, drunken house party that ends with broken furniture and tears.

So, no—they’re not literally printing physical cash (unless you count the Treasury😂). But the Fed controls how much money is floating around in the financial system, and that’s even more powerful. When they flood the economy with cash, you get bull markets, meme stocks pumping, and every crypto influencer suddenly becoming a “financial advisor.”

But when they tighten the money supply, it’s like ripping the aux cord at a rave—reality hits hard. Companies stop hiring, stocks nosedive, crypto collapses, and suddenly, that overpriced NFT you bought for "future generational wealth" is just a JPEG again.

The Fed’s got two big jobs, known as their dual mandate:

Keep inflation under control, because nobody wants to be paying $12 for a pack of gum.

Make sure people have jobs, because unemployed, broke people tend to riot.

To pull this off, the Fed has insane power over the U.S. financial system. They do things like:

Set interest rates (this is the big one, we’ll get to it soon).

Print money (quantitative easing, aka "let’s just make more cash and hope for the best").

Bail out banks when they screw up (looking at you, 2008).

Control the money supply so things don’t spiral out of control.

in short simple terms these guys decide how expensive your debt is, how much your investments make, and whether we’re in a bull or bear market. If the Fed f*cks up, everyone—from Wall Street to broke-ass college kids—is gonna feel it. Ant they do all that by controlling interest rate.

What are interest rates & why do they matter?

You’ve ever wondered why your mortgage got more expensive, why the stock market suddenly crashed, or why that artsy b*tch with an Etsy store suddenly had to get a real job, it all comes back to interest rates.

The Federal Reserve plays god with these rates, adjusting them to either stimulate the economy (let the party keep going) or slow it down (kick everyone out before the cops show up).

Let’s break this down step by step so you actually understand how interest rates control EVERYTHING.

WTF Are Interest Rates? (The Basics)

At its core, an interest rate is the price of money—what it costs to borrow cash.

If rates are low, borrowing is cheap, so people and businesses spend more.

If rates are high, borrowing is expensive, so people and businesses spend less.

The main rate that everyone freaks out about is: The Federal Funds Rate. This is the interest rate that banks charge each other for overnight loans. Sounds boring, right? Well, this one rate influences every other interest rate in the U.S. economy—from your credit card APR to mortgage rates to the return on your savings account. The Fed doesn’t directly control the loan you get on your car or house. But when they raise or lower the federal funds rate, every other rate in the economy follows.

Interest rates effect on the economy

Interest rates affect literally everything, from your stock portfolio to your rent. Here’s how:

📉 The stock market

High interest rates = Stocks Drop

Companies borrow less money, so they grow slower.

Investors shift out of stocks and into bonds (since bonds now offer better returns).

Speculative stocks (like tech & growth plays) get absolutely wrecked.

Low interest rates = Stocks Pump

Companies can borrow cheap money → More expansion → More profits → Stocks go up.

Investors leave low-yield bonds and jump into stocks (higher risk, higher reward).

Growth stocks thrive (tech, startups, meme stocks all rally).

Example: 2020–2021: The Fed dropped rates to near 0%, money was free, and Tesla, Bitcoin, and every dumb sh*tcoin went parabolic.

💰 The bond market

Bonds and interest rates have a toxic relationship—when one goes up, the other goes down.

High interest rates = Bond prices drop - Because newer bonds offer higher yields, making older ones worth less.

Low interest rates = Bond prices rise - Because older bonds have better yields than newly issued ones.

Example: In 2022, when the Fed aggressively raised rates, bond prices tanked, and everyone holding them got absolutely obliterated.

🏡 The housing market

Your mortgage rate is directly tied to interest rates.

High interest rates = Housing market slows down

Mortgages become more expensive → Fewer people buy homes → Housing prices drop.

Real estate investments lose value as borrowing costs rise.

Low interest rates = Housing booms

Mortgages become cheap → More people buy homes → Housing prices skyrocket.

Example: In 2020, 30-year mortgage rates were below 3%, so everyone and their mother started buying houses like crazy. By 2023, when rates hit 7%+, mortgage payments doubled, and the market froze up.

💳 Consumer debt (credit Cards, loans, & car payments)

The cost of borrowing money for regular people also depends on interest rates.

High interest rates = Credit gets expensive

Credit card APRs (Annual Percentage Rate) skyrocket.

Auto loans and personal loans become harder to afford.

Low interest rates = Borrowing is easy

People spend more because debt is cheap.

Businesses expand faster because they can finance projects easily.

Example: When the Fed raised rates in 2022–2023, credit card debt hit record highs because people couldn’t afford their payments anymore.

💵 The forex market

Interest rates don’t just affect America—they shake up global markets.

High U.S. interest rates = Stronger dollar ($USD goes up)

Foreign investors rush to buy U.S. bonds (because they offer higher returns).

Emerging market currencies get wrecked because their debt becomes harder to repay.

Low U.S. interest rates = Weaker dollar ($USD falls)

Money flows into riskier assets (like stocks and crypto).

Foreign currencies become more attractive to investors.

Example: In 2022, the Fed hiked rates aggressively, and the U.S. dollar ripped higher, crushing other currencies like the euro, yen, and British pound.

So you can clearly see now (I hope) that interest rates controll everything. If you don’t pay attention to them, you’re flying blind in the market and in your personal life as well. .

⁉️ Trading stocks? Rates determine if you’re in a bull or bear market.

⁉️ Buying a house? Rates determine if you can afford the mortgage.

⁉️ Holding cash? Rates determine how much your savings account pays you.

⁉️ Investing in bonds? Rates determine if you make or lose money.

⁉️ Trading forex? Rates determine if the dollar is going to f*ck over every other currency.

Bottom line? Interest rates are the financial cheat code that the Fed uses to control the entire economy. And the biggest place where they pull the trigger? Now, let’s talk about the Feds little sleepovers called FOMC meetings, where all the big decisions happen.

FOMC meetings: the Fed’s sleepover that moves markets

Alright, now that we know interest rates control everything, let’s talk about where those rate decisions actually happen—FOMC meetings. If you’ve ever seen stocks, bonds, crypto, and even the forex market go absolutely feral for no reason, chances are, it was because of one of these meetings. The Federal Open Market Committee (FOMC) meets 8 times a year, and every single one of these meetings is a potential market-moving event. It’s like the Fed’s version of a G7 Summit, but with more old guys in suits pretending they’re not playing 4D chess with your money.

Here’s the deal—traders, investors, and even government officials obsess over FOMC meetings because this is where the Fed announces what he is planning on doing. If the Fed raises rates, the market tanks. If they cut rates, the market pumps. But even if they do nothing, the market can still go apesh*t depending on what Jerome Powell says in the press conference. Which brings us to…

Who the f*ck Is Jerome Powell & why do everyone fears and worships him?

Jerome Powell—or as traders like to call him, JPOW or Daddy Powell is the Chairman of the Federal Reserve, aka the most powerful man in finance. His job is to control inflation, unemployment, and financial stability while trying not to accidentally crash the entire economy.

And let me tell you—when this man speaks, billions of dollars move instantly.

Every FOMC meeting has two key events that traders are glued to:

1️⃣ The Interest Rate Decision (2:00 PM ET)

The Fed announces if they’re raising, cutting, or holding rates.

If the decision is unexpected, the market reacts instantly.

2️⃣ Jerome Powell’s Press Conference (2:30 PM ET)

This is where JPOW steps up to the mic, and the entire financial world holds its breath.

Doesn’t matter what the rate decision was—what Powell says here can override everything.

If he sounds hawkish (more rate hikes coming) → Stocks dump, bonds crash, USD strengthens.

If he sounds dovish (rate cuts are coming) → Stocks rally, bonds pump, USD weakens.

☠️ The “Good Afternoon” Curse ☠️

If you think I’m joking about how obsessed traders are with Powell’s words, just watch what happens when he starts his press conferences with a simple: “Good afternoon.” That’s it. That’s all he says. And in that exact moment, you can see the S&P 500 twitch, algo traders start panic-buying or panic-selling, and Twitter (sorry, X) erupts with:

🚨 “JPOW JUST RUGGED US!”

🚨 “He said ‘good afternoon’ with a serious tone, we’re fcked.”*

🚨 “DID HE JUST SMIRK? BULLISH!!!”

Yes, people literally analyze this man’s tone, facial expressions, and pauses like it’s some kind of financial astrology. Because even if the Fed does nothing, Powell’s tone can send markets skyrocketing or crashing within seconds.

How FOMC meetings move markets

If you’re wondering why markets react so violently to these meetings, it’s because traders don’t just react to what the Fed does—they react to what the Fed might do next.

Here’s how different markets react to rate decisions & Powell’s pressers:

Rate hikes = Stocks tank (borrowing is expensive, corporate growth slows).

Rate cuts = Stocks pump (cheap money fuels speculation).

No change? Powell’s words decide everything—hawkish tone = bad, dovish tone = good.

🦅 Hawkish Powell (bad for markets)

“We need to keep fighting inflation.”

“Further rate hikes may be necessary.”

“Rates will stay higher for longer.”

🕊️ Dovish Powell (good for markets)

“We are seeing signs that inflation is cooling.”

“We will consider cutting rates in the future.”

“Monetary policy is working.”

How the Fed actually changes interest rates

Alright, so you get that interest rates control everything and that JPOW is the financial grim reaper, but here’s the thing—the Fed doesn’t just say a number, and banks instantly obey. That’s not how this works. Instead, they have to manipulate the financial system like a bunch of Wall Street sorcerers, using a few tools to force the economy to bend to their will. Here’s how they do it:

Open Market Operations (OMO)

This is the main way the Fed moves interest rates.

If they want to lower rates: They buys government bonds from banks. This floods the system with cash, making it cheaper to borrow.

If they want to raise rates: they sells bonds. This sucks money out of circulation, making it more expensive to borrow.

This is how the Fed controls the money supply—by deciding whether banks are swimming in cash or starving for it.

The Interest Rate on Reserves (IOR) – the Fed "bribes banks"

Banks keep extra cash parked at the Fed. The Fed pays them interest on that money.

Want banks to lend less? The Fed raises the interest it pays on reserves. Banks hoard cash instead of lending, and rates go up.

Want banks to lend more? The Fed lowers the interest it pays. Banks say “f*ck it” and start lending more, rates go down.

Basically, the Fed can make hoarding cash more attractive or less attractive depending on how much they want money to flow.

The Discount Rate – The emergency loan shark move

Banks can borrow directly from the Fed when they’re short on cash. The interest rate on those loans is called the Discount Rate.

Want rates higher? The Fed makes these loans expensive, forcing banks to raise the rates they charge everyone else.

Want rates lower? The Fed makes these loans cheap, so banks can afford to lend more freely.

This is like the Fed saying, “You need cash? Sure, but it’s gonna cost ya.”

How It All Comes Together

The Fed doesn’t just say “interest rates are now 5%” and call it a day. They use these three tools to manipulate banks into actually adjusting their rates:

1️⃣ Buying or selling bonds (to flood or drain money from the system).

2️⃣ Bribing banks with reserve interest (to make lending more or less attractive).

3️⃣ Setting the Discount Rate (to control emergency bank lending).

All of this trickles down to the rest of the economy, deciding how expensive your debt is, how much your savings earn, and whether the market pumps or dies. So yeah, it’s a whole game of financial 4D chess, and Powell is the dude making the moves.

How to trade & invest in different rate environments (AKA: how not to get rekt by the Fed)

Alright, so now you know how the Fed f*cks with interest rates and why Powell’s every word can send markets into euphoria or full-blown depression. But how do you actually position yourself so you don’t get wiped out every time the Fed decides to “adjust” the economy Easy. You just have to play the game the way they want you to. Here’s how:

When reates are rising (hawkish Fed)

If the Fed is hiking rates, they’re basically saying: "We’re making borrowing more expensive so the economy slows down." This is bearish AF for a lot of assets, but not all of them. Here’s what to avoid and what to focus on:

🚫 AVOID:

Tech & High-Growth Stocks – These companies rely on cheap money (low rates) to grow. When borrowing gets expensive, they get rekt.

Speculative Assets (Crypto, Meme Stocks, Unprofitable Startups) – Risky sh*t suffers when money isn’t free anymore.

✅ LOOK FOR:

Value Stocks (Stable, Cash-Flow Positive Companies) – Think banks, energy, consumer staples, stuff that isn’t based on hype.

Commodities (Gold, Oil, Industrial Metals) – Inflation usually sticks around when rates rise, so hard assets hold value.

Financials (Banks & Insurance Companies) – Higher rates = banks make more money on loans.

📉 Bonds? Meh. Bonds usually suck in rising rate environments because when new bonds start paying higher yields, old bonds lose value.

🏡 Real Estate? Pain. Mortgages get way more expensive, so demand for housing slows down.

TL;DR: If rates are rising, avoid high-risk plays and stick to stuff that actually makes money.

When rates are falling (dovish Fed)

If the Fed is cutting rates, they’re basically saying: "Money is cheap again, go nuts." And the market loves this sh*t. Here’s what pumps:

🚫 AVOID?

Banks & Financials – They make less money when rates drop.

Cash – If inflation stays high while rates fall, cash loses value faster.

✅ GO HEAVY ON:

Tech & Growth Stocks – When money is cheap, investors take more risks, and speculative plays thrive.

Bonds – Falling rates make existing bonds more valuable, so bonds pump.

Real Estate – Cheap mortgages = More buyers = Housing booms.

and when it comes to short term trading especially when you are a rookie or new to the markets, remember:

Comments